The five-point plan includes boosting the state’s rainy-day fund, tax relief for retirees, tax relief for Marylanders, help for underserved people, and “enhancement” for state employees — likely in the form of compensation.

Search Results

Ready, set, file! Tax Day is April 18

Tax Day is April 18 – three days later than usual. Have you filed yet?

Trump tax plan may be a mixed bag for Maryland

WASHINGTON – A majority of Marylanders weren’t particularly keen about the prospect of a Donald Trump presidency. Democratic nominee Hillary Clinton carried the Old Line State by roughly 624,000 votes on Nov. 8, good for a comfortable 25-point win. RELATED…

Gov. Larry Hogan Proposes Bill to Eliminate Veteran Income Tax

Gov. Larry Hogan announced a new bill that could eliminate income taxes for Maryland’s retired military veterans.

Supreme Court Hears Md. Case Questioning the Taxing of Out-of-State Income

People who earn out-of-state income and pay income taxes in those other states should not be subject to income taxes in their state of residency, argued a lawyer for a Maryland couple before the Supreme Court Wednesday.

Supreme Court to Hear Case on Right of States to Tax Out-of-State Income

The U.S. Supreme Court is set to hear a case involving a Maryland couple who believe their out-of-state income should not be taxed by their state of residence.

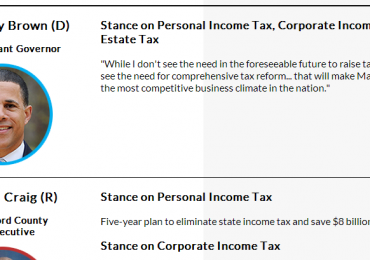

Gubernatorial Candidates Divided On How To Adjust or Cut State Taxes

All seven major gubernatorial candidates are taking a stance on one of Maryland’s hot-button issues: taxes. They propose adjustments or cuts to both corporate and personal income taxes, and two GOP candidates favor eliminating personal income taxes altogether

Bipartisan Tax Relief Measures Proposed in Maryland

Senate and House committees are weighing bipartisan legislation that could lower state income and sales tax rates, and raise the estate tax exemption threshold.