The percentage of college students in Maryland who defaulted on their federal student loans increased last year, as a tough job market for new grads put pressure on student borrowers.

The percentage of borrowers in the state that defaulted on their federal student loans within the first two years of repayment rose from 6.7 percent in 2008 to 7.8 percent in 2009, according to a Capital News Service analysis of data released this week by the U.S. Dept. of Education.

The high unemployment rate for new college graduates is the biggest factor behind the increase, said Mark Kantrowitz, publisher of FinAid and FastWeb, the largest free scholarship matching service in the country.

“If you graduate from college and can’t get a job, how can you pay your loans off?” Kantrowitz said.

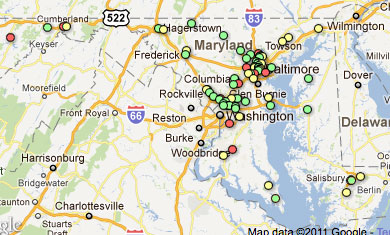

This map shows federal student loan default rates at colleges and universities in Maryland. Red dots indicate schools with higher than 15 percent default rate. Yellow dots between 8.8 and 15 percent. Green dots are below 8.8 percent. Credit: Brandon Cooper/Capital News Service.

The percentage of students in Maryland defaulting on their federal loans in the 2009 fiscal year that ended last Sept. 30 remained below the national average of 8.8 percent.

Heather Jarvis, a lawyer and expert on student loans, said that Maryland’s student default rate was likely lower than the national average because Maryland’s unemployment rate remained lower than the national average.

Maryland’s unemployment rate in July was 7.2 percent, compared to 9.1 percent nationally.

In keeping with national trends, students who attended for-profit colleges in Maryland were much more likely to default on their student loans than their counterparts at non-profit schools.

The CNS analysis of student loan data found that 11.9 percent of students at for-profit institutions in Maryland defaulted on their loans in 2009, compared with 4.6 percent at Maryland public schools and 3.5 percent at Maryland private schools.

More than half of all Maryland colleges saw an increase in the percentage of borrowers defaulting on federal student loans between 2008 and 2009.

The American Beauty Academy, a for-profit school located in Wheaton had the highest default rate in the state at 23.2 percent. Three schools in Baltimore – Baltimore City Community College, Saint Mary’s Seminary & University and Ner Israel Rabbinical College – had no students default last year.

Melissa Gregory, the College Director of Student Financial Aid at Montgomery College, said the biggest way schools can help students avoid default is to help them understand their obligations before taking out loans.

Gregory, who is the chair for the Maryland Community College Financial Aid Directors, cited financial literacy programs and one-on-one counseling as ways to guide borrowers. But, she said, there is only so much colleges can do when most students have to take out to loans to pay for college.

Jarvis, on the other hand, said that no borrower should be defaulting on their federal loans. She said students struggling to meet payments should enroll in an underused federal program known as the Income-Based Repayment Plan.

Borrowers enrolled in this program make monthly payments on their loans based on their income and family size.

The 11 public schools that are part of the University System of Maryland had especially low default rates on federal loans last year. The system, which includes schools like the University of Maryland, College Park, Salisbury University and Towson University, averaged a default rate of 4.7 percent.

Mike Lurie, a spokesman for the University System, credited the lower default rates to the schools “dramatically increasing institutional financial aid in recent years to ensure that students, and particularly the poorest students, graduate with less debt.”