ANNAPOLIS — Keeping in line with campaign goals that centered on tax reduction and spurring business development, Maryland Gov. Larry Hogan introduced a $42 billion budget proposal Wednesday.

The budget for fiscal year 2017 includes $6.3 billion in K-12 public education, which is $140 million more than last year. This means that every district will will see an increase in funding per student and $314 million statewide in new school construction.

Though the General Assembly mandates the governor fully fund education, Sen. Richard Madaleno, D-Montgomery, remained skeptical.

“The Governor ‘says’ he fully funds education,” said Madaleno, who is the vice-chair of the Senate Budget and Taxation committee. “His approach has been to do the minimum and that’s what he has done.”

Sean Johnson, the Assistant Executive Director of Political and Legislative Affairs for Maryland State Education Association, said he was “cautiously optimistic” about the governor’s budget.

The budget also includes a series of tax and fee reductions, which will cost $36 million. This includes the elimination of an electricity surcharge for the Environmental Trust Fund as well as tax cuts for about 640,000 senior citizens.

Hogan also wants to immediately increase the refundable earned income tax credit for 170,000 families to 28 percent, which would save those families around $27 million over the next two years.

In order to attract more businesses and manufacturers to places with high unemployment, Hogan’s budget included a plan for Western Maryland, the Eastern Shore and Baltimore City that would eliminate corporate sales tax and all state taxes for some businesses for 10 years. Employees at those businesses who make less than $65,000 a year would also pay no income taxes.

“During the past 8 years, unfortunately, Maryland lost 28 percent of its manufacturing base,” Hogan said in a radio interview Wednesday morning. “(That is) 25,000 manufacturing jobs — 200,000 jobs altogether.”

Hogan’s budget also includes $3.1 billion for transportation infrastructure, and $35 million to demolish some buildings to replace the Baltimore City Detention Center

Though some state employees will see a raise, between 2 and 4 percent, others will find themselves out of work. Part of Hogan’s plan to streamline state government is reducing the executive workforce to less than 50,000 workers. Some of that will come from not filling vacancies, but some will come from layoffs.

Hogan is now enjoying a 67 percent approval rating.

“I’m humbled and happy people are pleased with the job that I’m doing,” he said in a radio interview. “I wish I was this popular in high school.”

The state’s Rainy Day Fund will get an additional $235 million, bringing it up to $1.1 billion, which is more than the 5 percent of state revenues that is required.

Like education, there are other requirements that the governor must fund when he proposes his budget each year. These mandates mean that 83 percent of the budget is already spoken for, which some Republicans think is too high.

“Those formulas, many of which have been around since there was a rotary telephone, need to be looked at,” said Kathy Szeliga, R-Baltimore and Harford Counties.

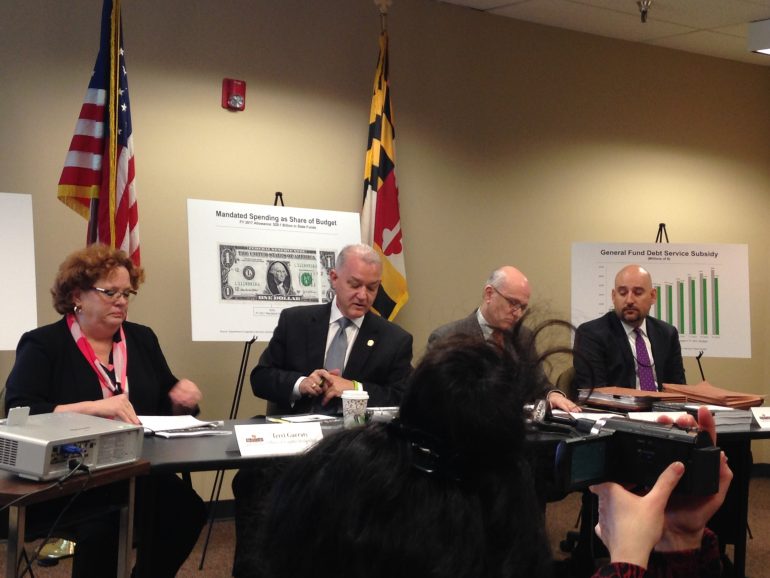

Secretary of Budget and Management David Brinkley said that mandated spending ties up too much of the budget, which could be problematic if the economy gets worse.

“In the current environment, we’re able to manage it,” Brinkley said. “ but if we end up in a correction, or if the economy turns a little bit different than where we’ve been (the 17 percent that is unmandated) is all we have to work on.”

Brinkley said he did not know specifically which mandates he thought should be reduced or cut.

“He wants to do away with some mandates, but we have to know what they are,” said House of Delegates Speaker Michael Busch.

The state is expected to have a $450 million surplus this year, and Hogan’s plan reduces the $5.1 billion deficit that he inherited in 2015 by 90 percent.

The governor later in the session may introduce a supplementary budget bill, which Brinkley said would include $75 million for blight removal in Baltimore over the next four years.

This year, the budget was introduced to the Senate, which may make revisions that spend less than Hogan’s proposed amount, but not more.

The Senate will then give it to the House of Delegates for revisions, and both chambers must pass the budget by April 4.

–CNS correspondent Connor Glowacki contributed to this report.

You must be logged in to post a comment.