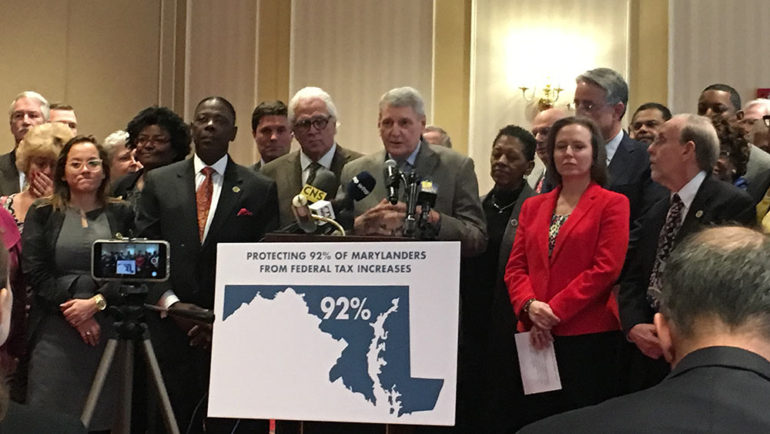

ANNAPOLIS, Maryland — Maryland Senate President Thomas V. “Mike” Miller Jr. and Speaker Michael Busch, both Democrats, on Tuesday in Annapolis laid out three points to offset changes in the recently passed Republican federal tax bill.

State lawmakers, in addition to the majority leaders, spoke of decoupling from new federal estate tax rates; restoring personal exemptions; and of deductions for charitable contributions.

The federal bill, they said, takes away income tax reductions for 92 percent of Marylanders while giving additional tax breaks to 0.1 percent of residents. Their plan aims to restore and offset those changes.

“We’re going to flesh this out over the next 85 days to make sure that Marylanders are protected in this system, that has been put upon them by the federal government,” Busch said.

Busch, who represents Anne Arundel, said they’ll seek counsel from accountants and members of Congress from Maryland as they hash out details. They’ll also work with states like New York and New Jersey, which were affected similarly.

Lawmakers did not include many details; Busch said they fully intend to have a solution before the end of the session.

Miller, who represents Calvert, Charles and Prince George’s, displayed a letter signed by Maryland’s nine Democratic members of Congress calling for relief from “double taxation.”

He said the state’s new tax plan for personal exemptions — cut under the GOP tax plan — is one per person. A family of five, he explained, would be able to claim five exemptions.

Miller also railed against the federal bill’s “so-called” relief to the middle class, which he said phases out in seven years.

“(Our plan) is going to have a billion dollars in tax relief to the people in the state of Maryland,” Miller said.

In a Democratic-controlled General Assembly, Miller and Busch have the votes to pass legislation along party lines if necessary.

They also have some leverage over Gov. Larry Hogan, the Republican incumbent who’s running for reelection in a traditionally Democratic stronghold.

Senate and House Democrats have already overriden two vetoes in the 90-day session’s very early days: paid sick leave and the Maryland Fair Access to Education Act.

Under the former law, which Hogan vetoed last spring, any business with 15 or more full-time employees will now be required to give workers at least five days of earned sick and safe leave. It’s expected to extend to over 500,000 Marylanders.

The Education Act, nicknamed “Ban the Box,” prohibits colleges and universities in Maryland from requesting information about the criminal history of applicants on initial admissions forms.

Hogan on Jan. 9 announced some of his own priority legislation, including a Government Accountability Act, which would establish term limits for legislators equal to that of the governor, and a Legislative Transparency Act, which would require all sessions of the Maryland General Assembly to be livestreamed on video.

Both bills are aimed at holding those in the legislature accountable. Hogan said the founding fathers envisioned “citizen representatives,” not “professional politicians,” who would represent their constituents before returning home to their “real jobs.”

Hogan said transparency of live video will allow the public to stay engaged on debates over issues that affect them.

“Legislators should be deliberating out in the open, in the light of day, instead of behind closed doors,” Hogan said.

For their plans on counteracting the federal tax bill, Democrats said Tuesday morning they’d welcome Republican support but haven’t yet heard from Hogan about his budget, which must be released by Wednesday.