The National Retail Federation predicted that an estimated 166.3 million people would be shopping from Thanksgiving Day through Cyber Monday, including Black Friday. That figure was surpassed by an additional reported 30 million holiday shoppers.

2022 is a particularly interesting year for retail because it’s the second year after the COVID-19 breakout and in-person shopping is not as restricted as it was during the early days of the pandemic. The Thanksgiving weekend reflected that by showing a 12% growth in in-store purchases, according to Mastercard SpendingPulse.

Another factor that makes holiday shopping peculiar this year is inflation – inflation was at a 40-year high in June, driving prices higher and placing consumers at a difficult spot with their finances. Despite that, more than $9 billion was spent on Black Friday online sales.

Shoppers set a record-high, spending $9.12 billion online on Black Friday sales, according to Adobe Analytics, despite inflation and looming recession. Most retailers expected lower-than-average profits from this year’s Black Friday sales due to inflation and the Federal Reserve’s interest rate hikes. The rising wave of layoffs from big companies like Amazon and Meta to smaller startups also point at a looming recession that experts predict for the coming years.

There was approximately a 2.5% increase in total online shopping revenue for Black Friday this year compared to the previous year, and a 47% increase from 2018. Adobe said the increase wasn’t just because of higher prices but was partly due to growing demand.

Online sales compared to in-store purchases showed consumers preference for shopping from the comfort of their homes. However, in-person shopping has still seen a rise since 2021, according to Mastercard SpendingPlus. In-store purchases increased by 12% over the Thanksgiving weekend compared to last year, but e-commerce grew even faster, by 14%.

According to the National Retail Federation, a record number of 196.7 million consumers shopped over the Thanksgiving holiday weekend – from Thanksgiving Day to Cyber Monday – in both online and in-person stores. This is the highest figure recorded since NRF started tracking the data in 2017. This year had a 9.4% uptick from 2021, equivalent to $17 million more consumers.

Cyber Monday has seen higher sales figures than Black Friday at least as far back as 2014, according to Adobe Analytics. This year, Cyber Monday generated a staggering $11.3 billion for retailers, 25% more than Black Friday. Patrick Brown, vice president of marketing and insights at Adobe, told NBC News that this trend “shows no signs of slowing down.”

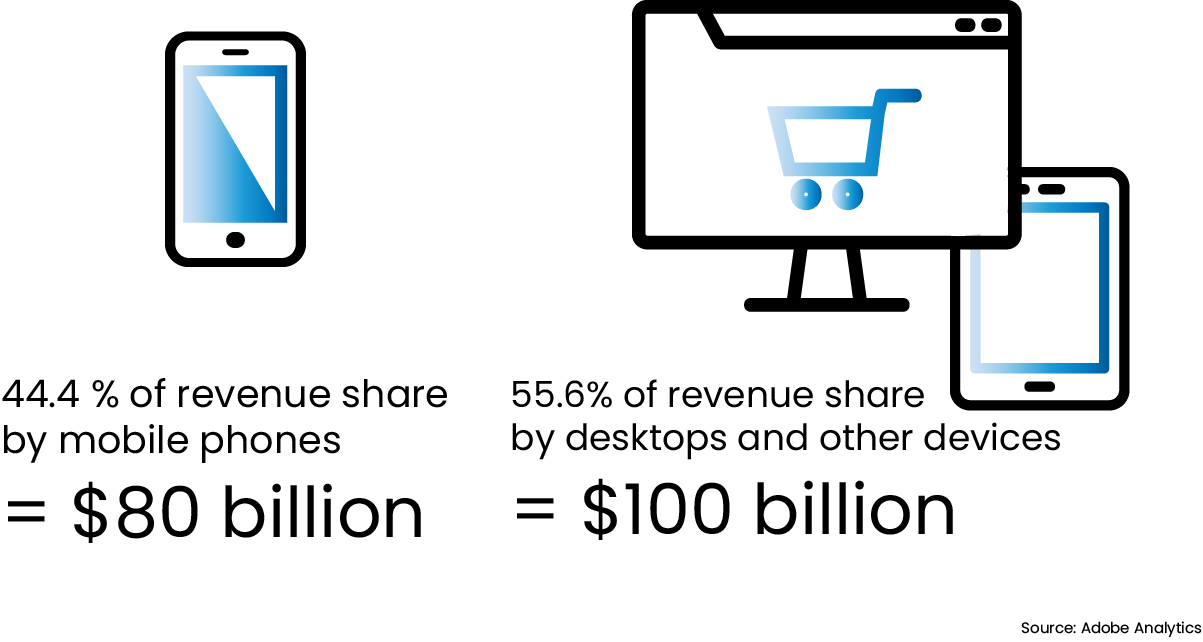

According to data from Adobe Analytics, many shoppers seemed to have reached for their mobile phones to shop during the holiday season. Shopping done by mobile devices contributed to 44% of the total revenue, equivalent to $80 billion dollars, tracked from October 1 to November 28, 2022. Desktops and other devices made up the rest, about $100 billion in revenue.

The top categories for discounts this year included toys and electronics. Toys like Legos and Hot Wheels and electronics like Apple MacBooks and PlayStation 5 were some of the hottest products of 2022, according to Adobe. Apparel, appliances and televisions were some of the other categories which had relatively high discounts.

You must be logged in to post a comment.