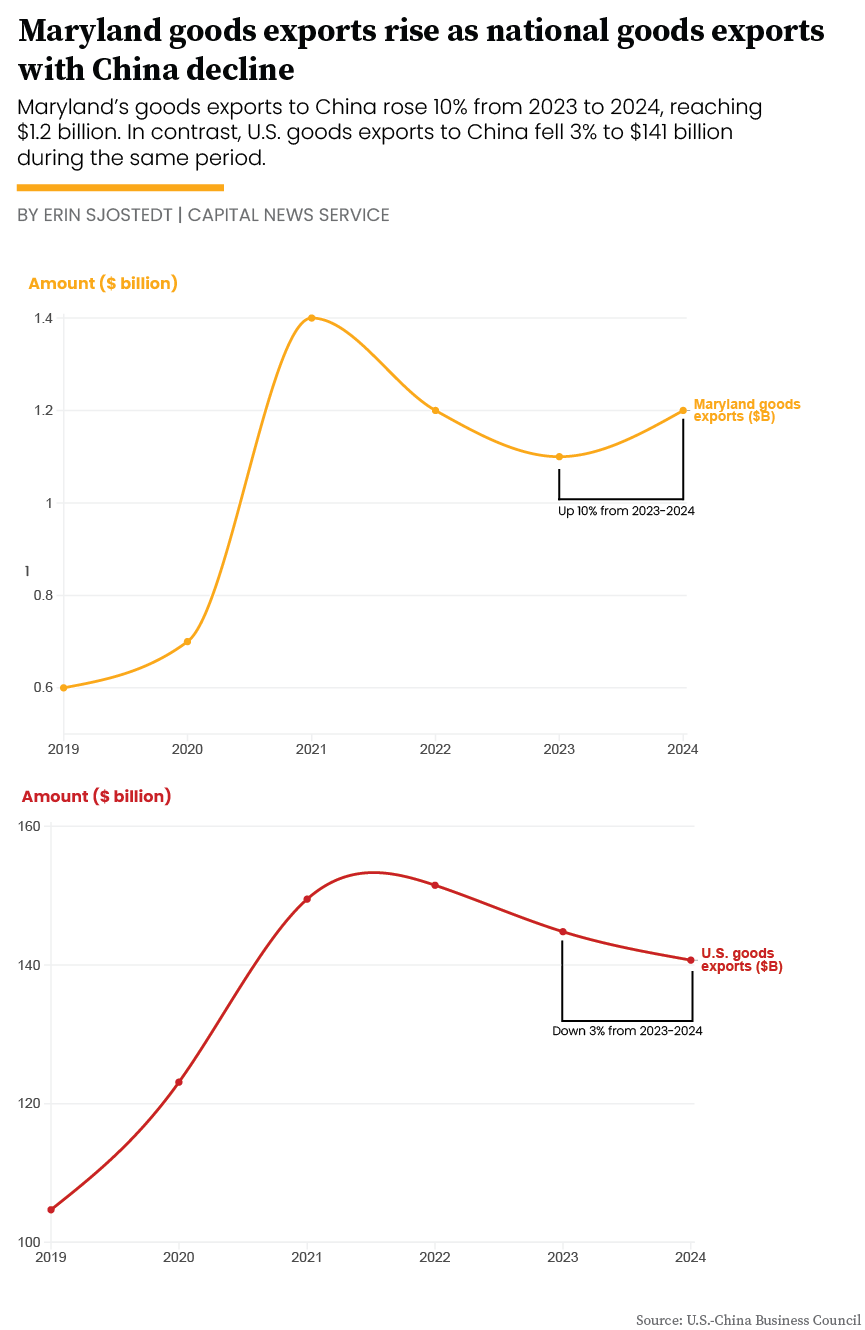

Maryland’s goods exports to China rose 10 percent last year, driven largely by surging coal and petroleum gas shipments, even as national exports declined, according to an April report from the U.S.-China Business Council, a non-partisan trade group representing American companies doing business in China.

However, new trade barriers introduced in early 2025, including U.S. tariffs of up to 145 percent and Chinese retaliatory tariffs of up to 125 percent, now threaten key Maryland industries and could drive up consumer prices, the USCBC said via email.

The tariffs introduced early this year target major sectors such as agriculture, energy and machinery. Although Maryland’s trade with China had been growing before these measures took effect, the USCBC warned that the new barriers could disrupt future growth and increase costs for both businesses and consumers.

Joshua Shifrinson, an international trade expert and associate professor of international relations at the University of Maryland, noted that while states like Maryland can sometimes soften the effects of national-scale trade tensions, they are still largely subject to federal policies.

“It’s certainly possible for individual states to adapt to national-level disruptions,” Shifrinson said. “For instance, states like Maryland can try to offset national-level tariffs by offering foreign firms preferential deals such as tax breaks. However, being a part of the U.S., there is only so much states can do.”

The USCBC said that the speed at which the U.S.-China trade is declining is “particularly worrisome.” Stockpiles of goods imported before the tariffs took effect are running out. “The impact will start to become visible to consumers in late May if both governments can’t agree to remove or significantly reduce their tariffs,” the USCBC stated, citing a report from Apollo Global Management, a private equity and investment firm.

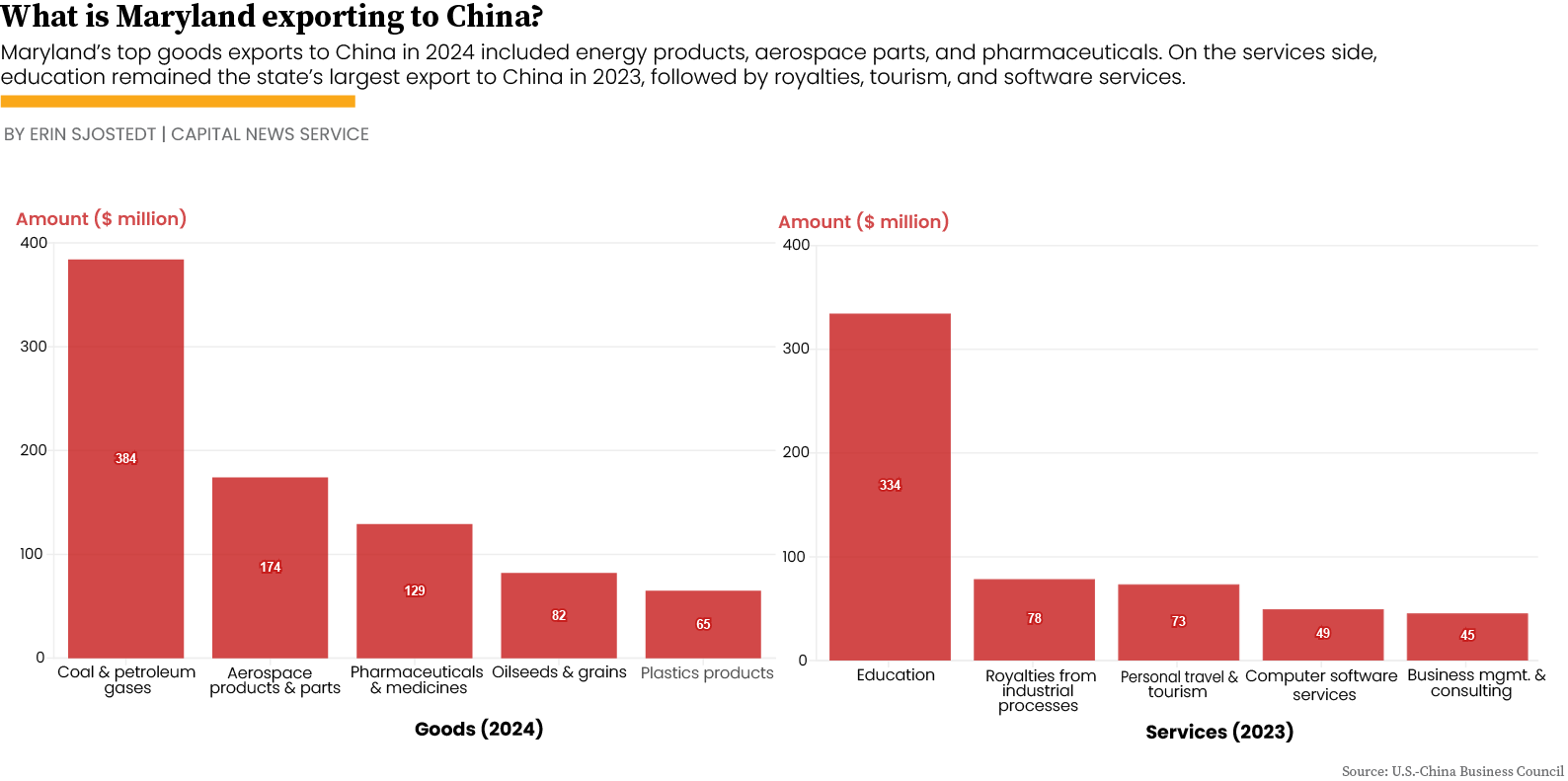

Maryland’s top merchandise exports to China in 2024 included coal and petroleum gases, aerospace products and pharmaceuticals. “Coal and petroleum gas exports to China were a major boon for the state, increasing $143.4 million last year, roughly 60 percent year over year,” according to the USCBC. Growth in these energy and aerospace exports offset declines in agricultural goods in the same year.

Shifrinson said the types of products Maryland trades with China may have helped shield the state’s exporters from some trade tensions.

These industries present both opportunities and challenges for Maryland. Some sectors might continue performing well despite the tariffs, while others, including aerospace and pharmaceuticals, could be more vulnerable, according to Shifrinson. The USCBC said that coal and oilseeds, two of Maryland’s largest exports, are subject to additional retaliatory tariffs, making them especially affected.

Maryland “punches slightly above its economic weight” in exports to China, ranking 12th among U.S. states according to the USCBC. “China is a significant export destination for the state, with 7 percent of its total exports being destined for China last year,” the council stated.

U.S. goods exports to China fell for a second consecutive year, dropping from $145 billion in 2023 to $141 billion in 2024.

Maryland’s goods exports to China increased from approximately $1.1 billion to $1.2 billion over the same period, according to the USCBC. China represented 7 percent of Maryland’s foreign goods exports and 5 percent of its foreign services exports in 2024. Though Maryland trails larger export powerhouses like Texas and California, China’s share of the state’s trade portfolio has grown.

Maryland exports to China also supported more than 11,000 jobs in the state in 2022 and 2023. Those jobs included both direct employees who created goods and services and employees in supply chains and related industries. The USCBC said those jobs “are at significant risk” unless both countries take steps to lower tariffs.

Services, which are not usually subject to tariffs, also showed gains in the recent USCBC report. Maryland’s service exports to China increased 10 percent from 2022 to 2023. Education, Maryland’s top service export to China at $334 million in 2023, depends heavily on international student enrollment.

Johns Hopkins University and the University of Maryland have historically drawn large numbers of international students, including many from China. While education exports have recovered to near pre-pandemic levels, Chinese student enrollment in the United States overall fell 4 percent, the USCBC reported. Chinese enrollment at the University of Maryland as of fall 2024 has fallen 50% since its 2017 peak, according to data from the university.

Looking ahead, Shifrinson said the greatest threat to Maryland exporters may be uncertainty itself. “Businesses tend not to like risk”, Shifrinson said. “It’s not just the policies at hand, but the sense that events could change rapidly and unexpectedly that may harm state-level exports.”

At the same time, Shifrinson said state-level workarounds could provide new opportunities, particularly if foreign companies seek to onshore production or invest in states like Maryland.

“For all the attention paid to the trade war, it’s important not to view this primarily through an economic lens,” he added. “The fears driving the current policies are largely strategic and security in nature. We need to view the economics tool in light of strategic considerations.”

While the full impact of the 2025 tariffs is yet to be seen, the USCBC believes Maryland’s higher-value, more diversified exported goods may help the state withstand evolving trade conditions better than some others.

You must be logged in to post a comment.